Yahsat joins public market listing rush

Emirati fleet operator Yahsat plans to list at least 30% of its shares on the Abu Dhabi Securities Exchange in the third quarter of this year. SpaceNews

TAMPA, Fla. — Emirati fleet operator Yahsat plans to list at least 30% of its shares on the Abu Dhabi Securities Exchange in the third quarter of this year.

Mubadala, the United Arab Emirates’ state-owned investment company, will remain the satellite operator’s majority shareholder after it goes public.

Mubadala has owned Yahsat since its founding in 2007, as part of efforts to broaden the UAE’s economy beyond oil and gas.

“In line with our mandate to drive technological transformation and economic diversification of the UAE, we strive to develop a world-class innovation and technology-driven ecosystem that attracts investment in Abu Dhabi and the UAE more broadly,” said Musabbeh Al Kaabi, CEO of UAE investments at Mubadala and chair of Yahsat.

“Mubadala has supported Yahsat’s growth since inception, enabling it to become one of the world’s leading fixed and mobile satellite communication providers.”

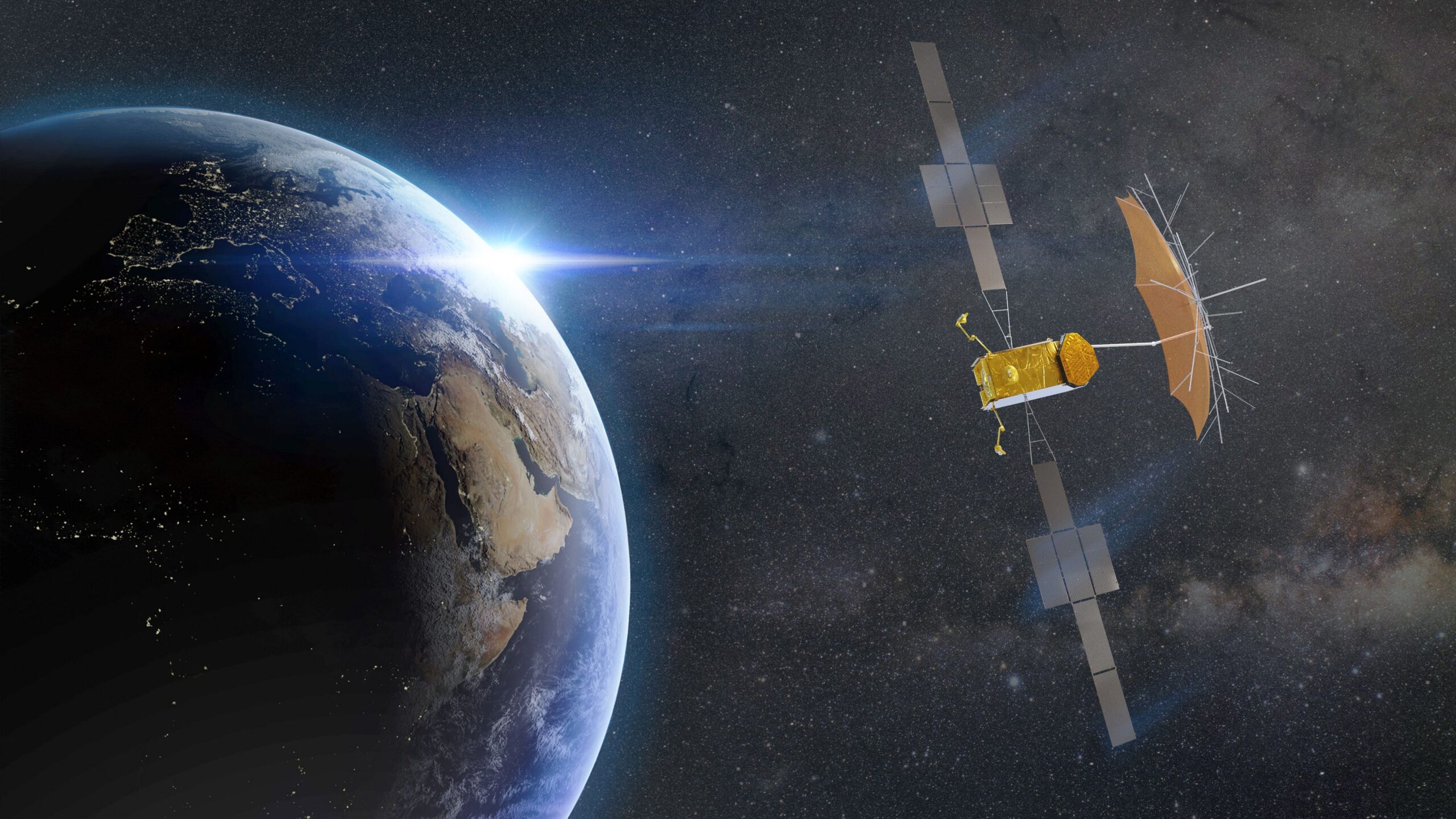

Yahsat said it provides broadband, broadcast and mobility services in more than 150 countries with its fleet of five satellites.

Two of those satellites came from fellow Emirati operator Thuraya, which Yahsat acquired in 2018 as part of its increasingly global ambitions.

Yahsat awarded Airbus Defence and Space a contract in August 2020 to build a satellite to refresh Thuraya’s legacy L-band network, slated to launch in 2024.

Yahsat and Airbus recently completed a preliminary design review (PDR) to construct the Thuraya 4-NGS satellite, which will target maritime, internet of things devices and data solutions.

It is part of a $500 million program that Yahsat said will transform Thuraya’s space and ground systems to pave the way for next-generation products.

Ali Al Hashemi, who replaced Masood Sharif Mahmood as Yahsat CEO in April after nearly nine years in the role, said plans to trade on the public market will help it “build on our strong national and international partnerships and invest in new technologies to drive future growth.”

Yahsat plans to sell between 731.9 million and 975.9 million shares, according to an offer document advertised in The National newspaper, corresponding to a stake of between 30% and 40%.

First Abu Dhabi Bank PJSC, Merrill Lynch International and Morgan Stanley & Co. International plc are coordinating the listing.

Early-stage space technology investor Seraphim Capital unveiled plans June 11 to trade on the London Stock Exchange, amid a growing trend in the industry toward the public markets.