What a Biden presidency could mean for your portfolio

U.S. futures point to a positive open ahead of Inauguration Day in Washington and a busy slate of corporate earnings.

This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning, Bull Sheeters! The 46th president of the United States will be sworn in today, and the mood in the markets is upbeat. Cautiously upbeat.

The source of investor exuberance is coming more from Wall Street than Washington, it must be said. A host of earnings beats from the likes of Netflix, Goldman Sachs and Bank of America yesterday is fueling the risk-on mood. More big names report today.

Are you still nervous about how the prospect of one-party rule in Washington will impact your portfolio? I’ve got you covered in today’s essay.

But first, let’s see where investors are putting their money.

Markets update

Asia

- The major Asia indexes are mostly higher in afternoon trading with Hong Kong’s Hang Seng up 1.1%.

- Jack Ma is back. China’s best known and most visible tech entrepreneur made his first public appearance in two months. Investors cheered, sending shares in Alibaba 9.3% higher at one point on Wednesday.

- Take a bow, Taiex. Taiwan’s stock exchange soared 92% over the past four years, earning the crown of the best-performing stock market of the Trump years.

Europe

- The European bourses were mostly higher in early trading with the Stoxx Europe 600 up 0.2% an hour into the trading session.

- The chip boom has been good news for Dutch tech giant ASML, which reported a big earnings beat on Wednesday.

- The European Union wants the euro to be the emergent currency in global trade, starting with green finance. The euro was up on this morning after the European Commission outlined its plans yesterday to bolster the common currency.

- Italian PM Giuseppe Conte survived a no-confidence vote on Tuesday night, but the government emerges weaker than ever. His nemesis, Matteo Renzi, the former mayor of Florence, apparently needs to re-read another Florentine, Machiavelli. Renzi’s attempt to topple the government was the equivalent of placing a wad of sticky chewing gum on the teacher’s seat.

U.S.

- U.S. futures are up slightly this morning. That’s after all three exchanges closed Tuesday in the green, helped by decent earnings from the likes of Bank of America and Goldman Sachs.

- Netflix shares are soaring in pre-market trading this morning, up 12.3%. That’s after the streaming service absolutely crushed it last quarter, attracting 8.5 million new subscribers to shows like “Bridgerton” and “The Queen’s Gambit.” Who knew there were so many chess fanatics out there?

- On the earnings calendar today we have: Morgan Stanley, Procter & Gamble and United Airlines, to name a few.

Elsewhere

- Gold is up, trading above $1,850/ounce.

- The dollar is down.

- Crude is up, with Brent trading above $56/barrel.

- Bitcoin is down 4.3% in the past 24 hours to $35,700.

***

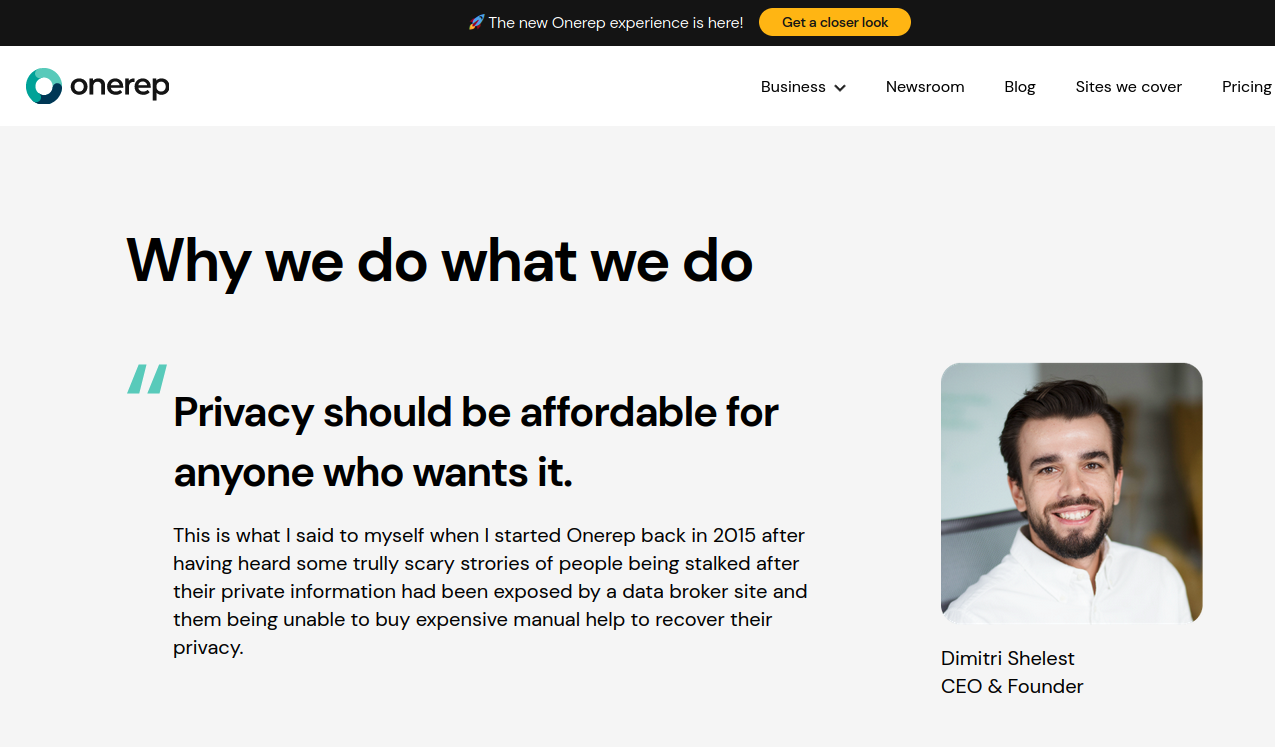

Tangled up in blue

It’s Inauguration Day, and so I’m going to dip back into the archive to borrow from an article I wrote in October on the eve of Election Day, for our last Quarterly Investment Guide. (Programming note: Fortune will publish the next QIG in the coming days; stay tuned.)

At the time, Donald Trump had just come down with COVID-19 (yes, that was just a few months ago), and the markets continued to chug higher as Wall Street began to price in the prospects of a blue sweep.

Ian Lyngen, a BMO Capital Markets bond analyst, wrote in an investors note at the time that a Joe Biden victory “could prove a decidedly positive event for domestic equities.”

Lyngen nailed it. The S&P 500 is up more than 12% since the start of Q4.

That performance might surprise some people. “Ordinarily,” I wrote back then, “Wall Street hates one-party control. And, if anything, it usually prefers a low-tax, regulation-busting Republican in the Oval Office. That anxiety runs deep, even if the historical data doesn’t quite back up the paranoia.”

History has shown that, yes, the S&P have performed better in years of split-party control. But, as the chart shows here, the U.S. economy has performed best in years when there’s a Democrat in the White House and a Democrat controlled Congress.

That trend will almost certainly continue this year as economists expect the U.S. economy to rebound strongly in 2021, helped by a gusher of stimulus spending. After the Georgia run-off elections, Goldman Sachs upped the 2021 U.S. growth rate to 6.4%. Incidentally, Goldman also penciled in a 13% rise in the S&P this year, more or less in line with the historical average for a Democrat-controlled Washington (see chart above.)

Now, we all know past performance is no indicator of future returns. And, of course, a new axis of power in Washington will mean there’s a new batch of winners and losers. The dollar is clearly in the latter camp. Small-cap stocks are squarely in the former as investors bet on a comeback of the American economy.

Sure, a tax hike looms. And America’s finances are a basket case. But the markets aren’t pricing any of that in. Not yet, anyhow.

And of course, we’ll keep you informed if any of that’s about to change.

***

Postscript

I’ve heard from plenty of Bull Sheet readers in the past 24 hours. I can promise you this: I will share with you in the coming days our recipe for the exquisite ribollita, a hardy dish for the dead of winter.

Turns out we’ve never written it down, so I’ll need to make some notes and double-check them with my partner in crime.

In the meantime, bug your butcher for pig bones. You’ll need them for this recipe.

***

Have a nice day, everyone. I’ll see you here tomorrow… Until then, there’s more news below.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.