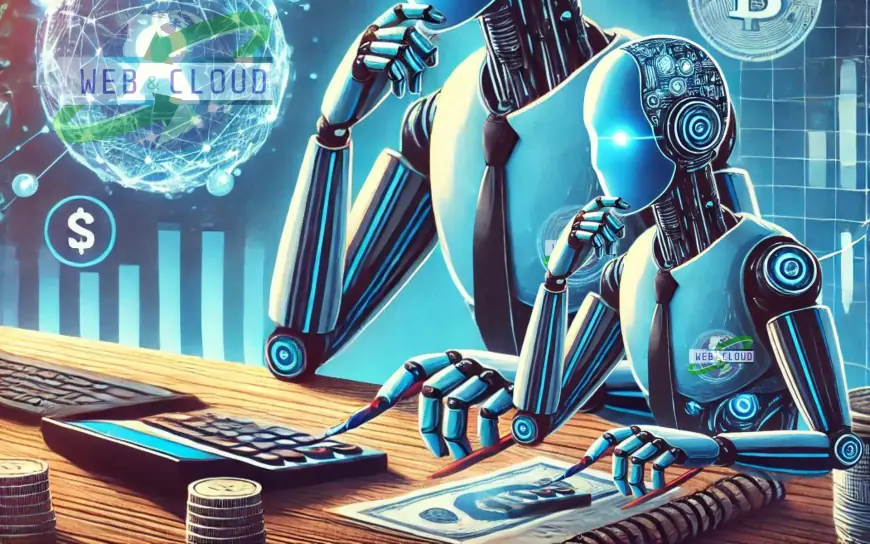

Should You Rely on AI or ChatGPT for Financial Advice? Read These Pros and Cons First

While AI-driven tools can offer substantial benefits in financial planning and advice, it's crucial to weigh these advantages against potential drawbacks. Read these Pros and Cons first.

The rise of AI and platforms like ChatGPT has revolutionized many industries, including finance. While AI-driven tools can offer substantial benefits in financial planning and advice, it's crucial to weigh these advantages against potential drawbacks. This article delves into the pros and cons of relying on AI or ChatGPT for financial advice.

Pros of Using AI for Financial Advice

1. Data-Driven Insights

- AI can analyze vast amounts of data quickly and efficiently, providing insights based on historical trends and complex algorithms that humans might overlook.

- These tools can process real-time data and offer up-to-date advice, which is particularly beneficial in the fast-paced financial markets.

2. Accessibility and Convenience

- AI-driven financial advice is accessible 24/7, unlike human advisors who have specific working hours. This availability allows users to get assistance whenever they need it.

- It's often more affordable than traditional financial advising services, making financial planning more accessible to a broader audience.

3. Objective Analysis

- AI provides objective advice based on data without emotional bias, ensuring a level-headed approach to financial decision-making.

- It can help mitigate common human errors driven by emotional responses to market fluctuations.

Cons of Using AI for Financial Advice

1. Lack of Personalization

- While AI can offer general advice based on data, it may not fully understand or consider individual circumstances, goals, and risk tolerance.

- Human financial advisors can provide tailored advice and develop a personal relationship with their clients, which AI currently cannot replicate.

2. Over-Reliance on Algorithms

- AI systems rely on historical data and programmed algorithms, which might not always account for unprecedented events or market anomalies.

- There's a risk that users might overly depend on AI recommendations without applying their own judgment or consulting human advisors.

3. Transparency and Trust

- The decision-making process of AI algorithms can be opaque, making it challenging for users to understand how certain recommendations are generated.

- Trusting AI with significant financial decisions requires a leap of faith, as users might be skeptical about the accuracy and reliability of AI-driven advice.

Conclusion

AI and ChatGPT offer valuable tools for financial planning, providing data-driven insights, accessibility, and objectivity. However, they also come with limitations, including a lack of personalization, potential over-reliance on algorithms, and transparency issues. A balanced approach, combining AI insights with human expertise, can provide a more comprehensive and personalized financial strategy. As technology continues to evolve, finding the right mix of AI and human advice will be key to making informed and effective financial decisions.