NVIDIA Grace Hopper Superchip Accelerates Murex MX.3 Analytics Performance, Reduces Power Consumption

After the 2008 financial crisis and increased risk-management regulations that followed, Pierre Spatz anticipated banks would focus on reducing computing expenses. As head of quantitative research at Murex, a trading and risk management software company based in Paris, Spatz adopted NVIDIA’s CUDA and GPU-accelerated computing, aiming for top performance and energy efficiency. Always seeking the Read Article

After the 2008 financial crisis and increased risk-management regulations that followed, Pierre Spatz anticipated banks would focus on reducing computing expenses.

As head of quantitative research at Murex, a trading and risk management software company based in Paris, Spatz adopted NVIDIA’s CUDA and GPU-accelerated computing, aiming for top performance and energy efficiency.

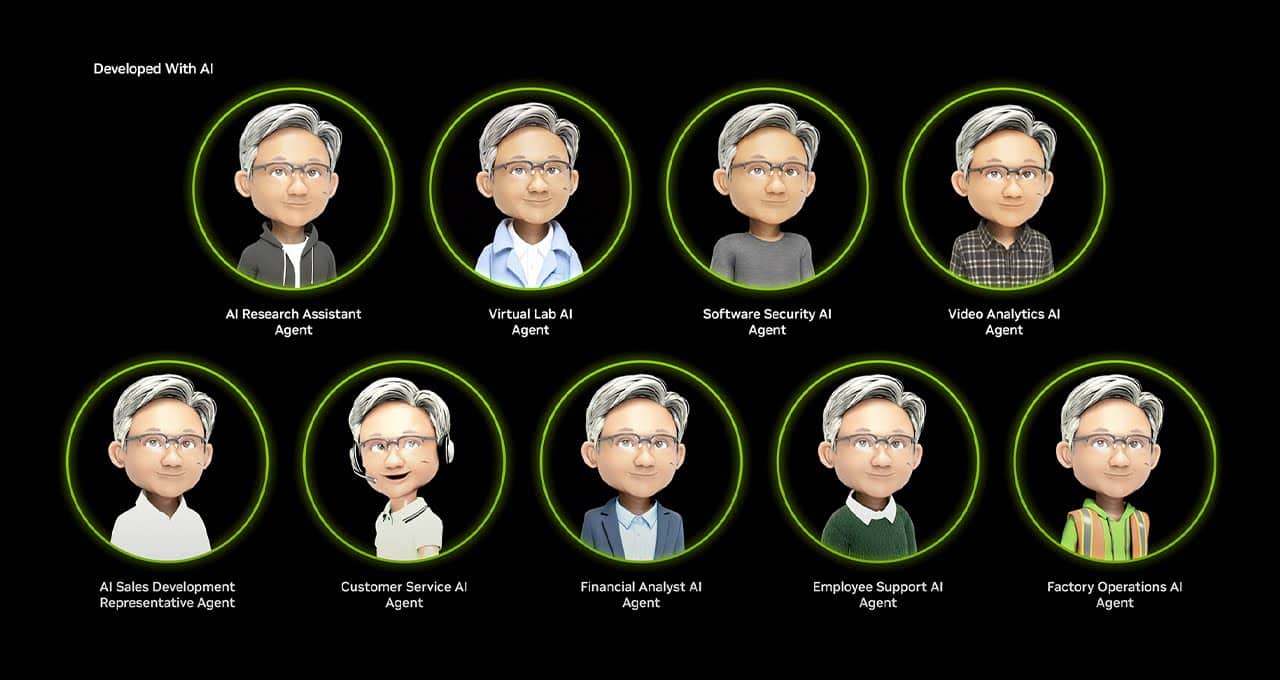

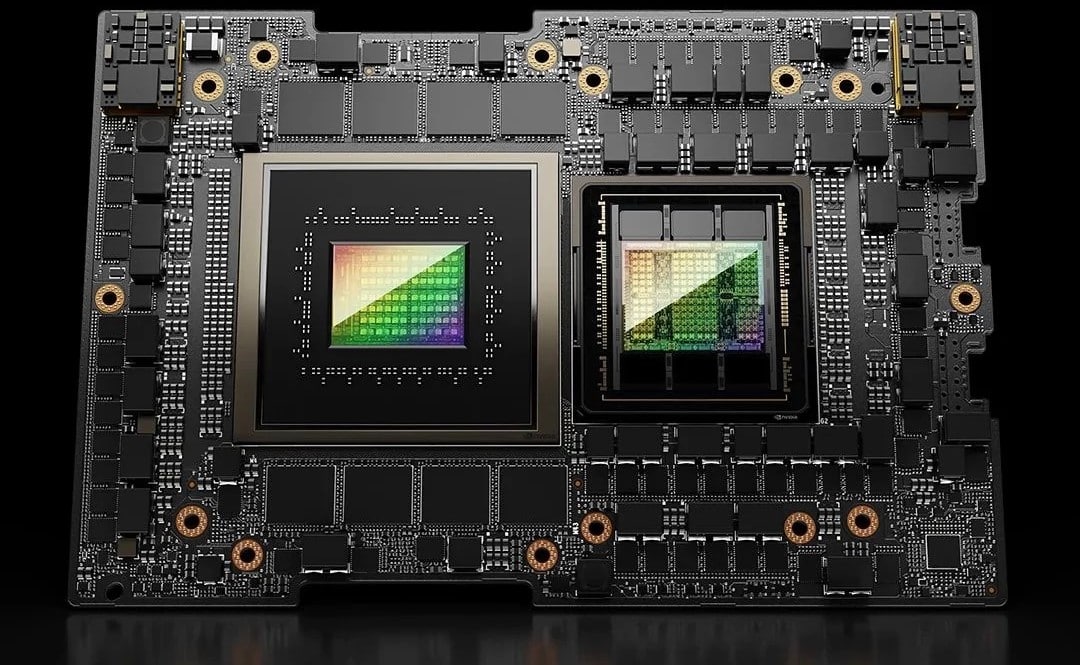

Always seeking the latest technologies, the company’s quants team has begun trials of the NVIDIA Grace Hopper Superchip. The effort is focused on helping customers better price and manage credit and market risk exposures of derivatives contracts.

More than 60,000 daily users in 65 countries rely on the Murex MX.3 platform. MX.3 assists banks, asset managers, pension funds and other financial institutions with their trading, risk and operations across asset classes.

Managing Risk With MX.3 Driven by Grace Hopper

Financial institutions need high-performance computing infrastructure to run risk models on vast amounts of data for pricing and risk calculations, and to deliver real-time decision-making capabilities.

MX.3 coverage includes both credit and market risk, fundamental review of the trading book and x-valuation adjustment (XVA). XVA is used for different types of valuation adjustments related to derivative contracts, such as the credit value adjustment (CVA), the margin value adjustment and the funding valuation adjustment.

Murex is testing Grace Hopper on the MX.3 platform for XVA calculations, as well as for market risk calibration, pricing evaluation, sensitivity, and profit and loss calculations on various asset classes.

Grace Hopper offers faster calculation as well as power savings to the Murex platform.

“On counterparty credit risk workloads such as CVA, Grace Hopper is the perfect fit, leveraging a heterogeneous architecture with a unique mix of CPU and GPU computations,” Spatz said. “On risk calculations, Grace is not only the fastest processor, but also far more power-efficient, making green IT a reality in the trading world.”

When running XVA workloads in MX.3, the Murex research and development lab has noticed Grace Hopper can offer a 4x reduction in energy consumption and a 7x performance improvement compared with CPU-based systems.

Pricing FX Barrier Options in MX.3 With Grace Hopper

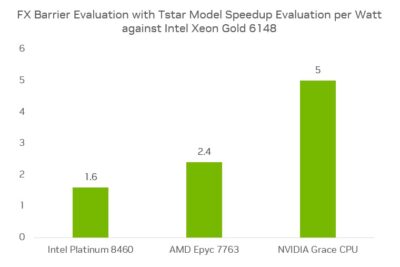

To price foreign exchange (FX) barrier options, Murex has used its flagship and latest stochastic local volatility model and also noticed impressive performance improvements when running on Grace Hopper. A barrier option is a derivative with a payoff that relies on whether its underlying asset price reaches or crosses a specified threshold during the span of the option contract.

The pricing evaluation is done with a 2D partial differential equation, which is more cost-effective on the Arm-based NVIDIA Grace CPU in GH200. Pricing this derivative with MX.3 on Grace Hopper goes 2.3x faster compared with Intel Xeon Gold 6148.

The NVIDIA Grace CPU also offers significant power efficiencies for FX barrier calculations on a watts-per-server basis, and it’s 5x better.

NVIDIA’s next-generation accelerated computing platform is driving energy efficiency and cost-saving for high-performance computing for quantitative analytics in capital markets, says Murex, pointing to the results above.

Learn about NVIDIA AI solutions for financial services.