Notable Stock Screeners for 2021

Stock Screeners By this point, you probably already heard about everything that happened with GameStop (GME) stocks. GameStop is the largest video game retailer with 5,000 stores around the U.S. Due to the pandemic, the company had been struggling for Source

By this point, you probably already heard about everything that happened with GameStop (GME) stocks. GameStop is the largest video game retailer with 5,000 stores around the U.S. Due to the pandemic, the company had been struggling for the past months and the plan was to turn a profit in 2023.

But everything changed when day traders that had already bought GameStop stocks started to short sell them, a technique where you bet against the company’s stock predicting that they will go down.

After this, it was clear the increase in the number of people looking for great opportunities to invest and make money out of it. That’s why we’ll list and explain below some leading cloud-based stock screening services to help those looking to start investing.

UNDERSTANDING STOCK SCREENERS

Searching for new stock trades tends to be time-consuming as it can become confusing and tricky to find the best opportunities in the middle of all the stock opportunities available.

That’s why using a stock screener can be the best solution for investors. This service filters the best stocks according to your needs and the filters you are researching. The better the service, the easiest it will become to find the stocks you need.

One of the many advantages of the stock screeners is the possibility of adding the best stocks you find in a portfolio in order to keep an eye on them and see if they are worth investing in.

But choosing a good stock screener can become tricky as the list of platforms and websites providing this service. So below, you’ll find our list with the 6 best stock screeners for 2021 not only for the experienced investors but also for the casual ones.

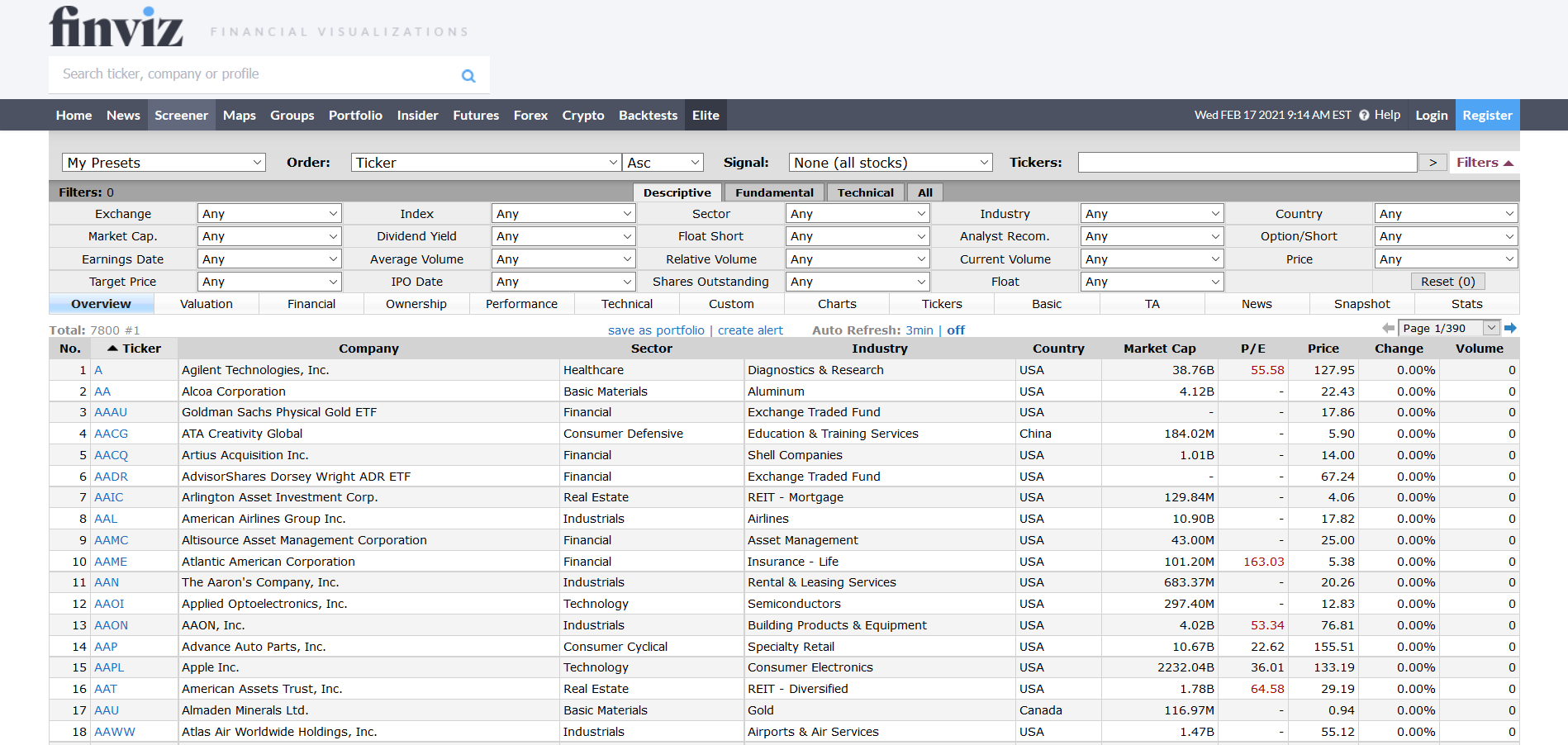

FINVIZ

Finviz is one of the best stock screeners services simply for its easy-to-use interface and the filters and criteria the investor can select — around 29 filters and 17 criteria.

The best part is that Finviz has a free plan for those starting to use this service, and later it’s possible to sign their paid plans, that start at $25 per month, and have more advanced features, like the real-time stock scanner.

It’s a robust platform for those starting to invest and will offer a great background to start. Their free plan doesn’t even require a sign-up and when you start to sense that you need a more advanced platform, you can start looking for other options.

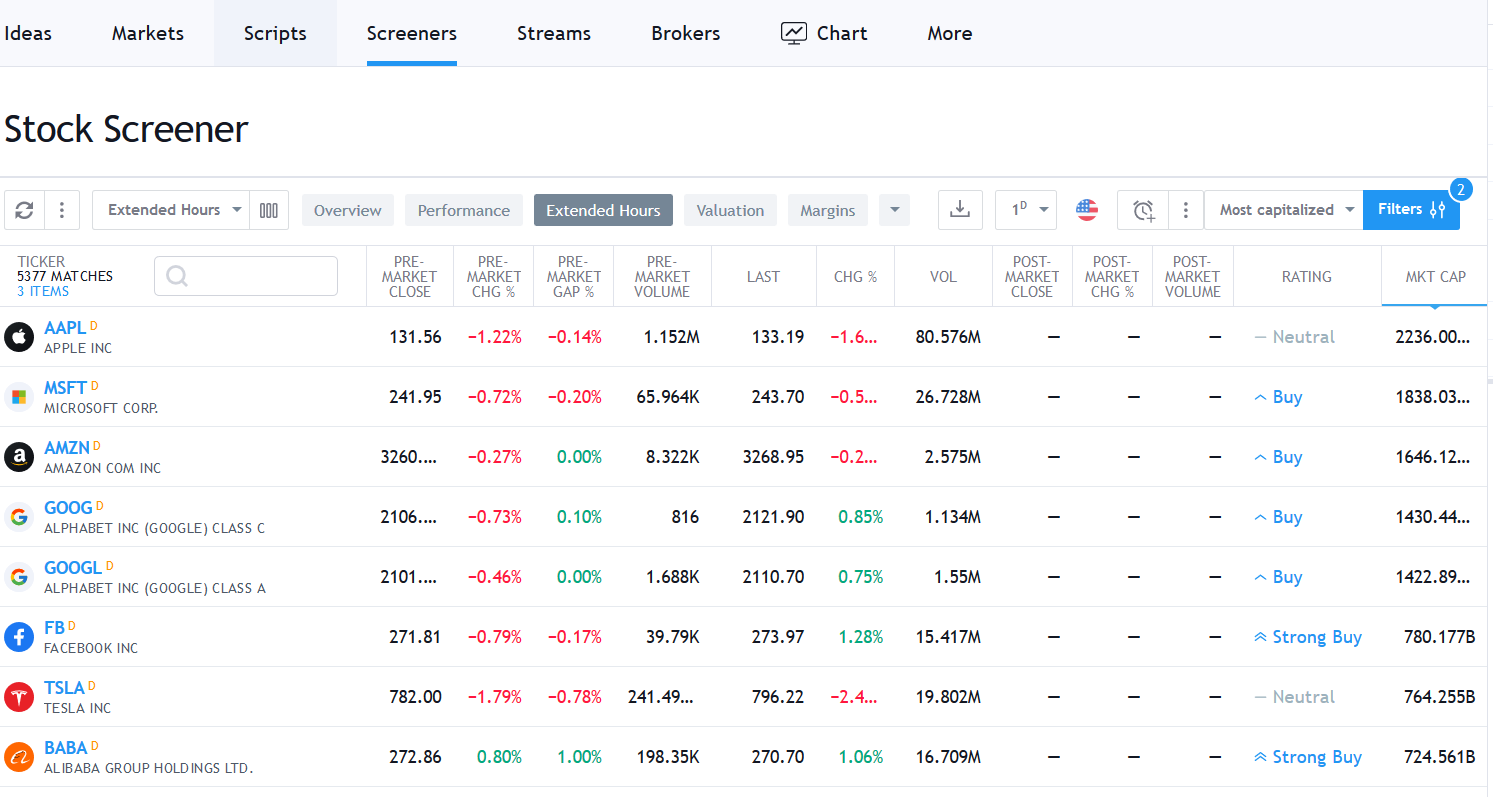

TRADINGVIEW

TradingView is also user-friendly with a platform easy to understand. You can swap from ETFs to stocks only — a feature that not all stock screeners can offer — and filter them between their 150 criteria.

New investors can find it a little overwhelming at first use, but it’s super intuitive and flexible. To screen stocks and ETFs you don’t need to sign up or start a premium option at first. It’s ideal to start testing the platform and see how you like it.

TradingView also offers the possibility of investing in international stocks and comparing their prices with the American ones. The platform is completely safe, and you can even have the access to cryptocurrencies and make a foreign exchange.

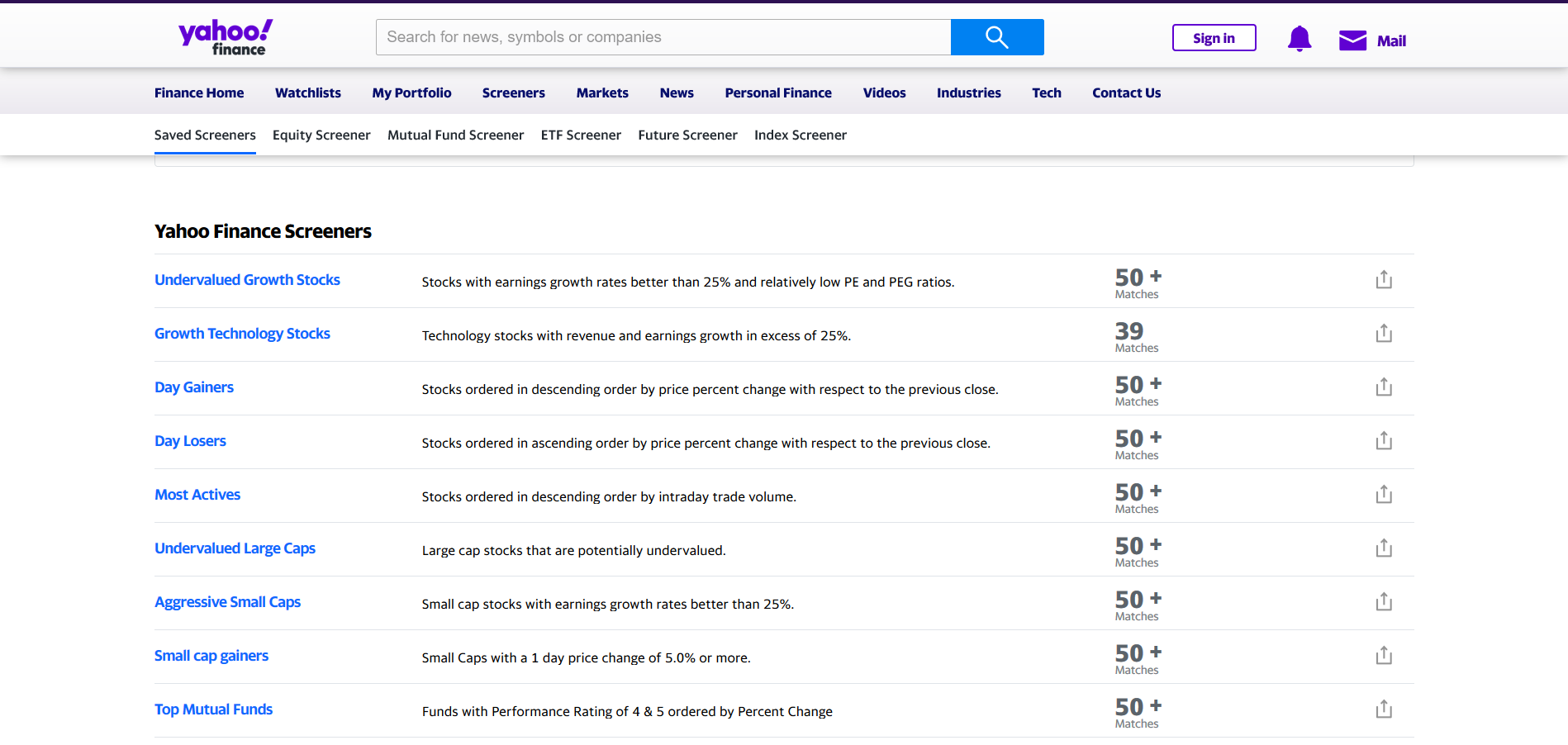

YAHOO FINANCE

Yahoo Finance is a very simple platform, and incredibly easy to use. For more advanced investors this option can lack some important technical criteria, but for those starting it can be perfect.

A great feature of this stock screener is the list of ESG scores for free and the possibility of viewing the data as a list or as a heatmap.