Positive Digital Asset Trend after the election: Bitcoin is now $69,982.76 and Ethereum: $2,446.14.

Following the re-election of President-elect Donald Trump, digital asset stocks are showing a significant positive trend. Bitcoin is up by 3.24%, trading around $69,982.76. Ethereum 0.72%, currently at $2,446.14.

President-elect Donald Trump and the Positive Trend in Digital Asset Stocks

Digital assets, encompassing cryptocurrencies, stablecoins, tokens, and non-fungible tokens (NFTs), have significantly transformed the financial landscape. These innovations not only promise increased efficiency and transparency but also offer new avenues for financial inclusion and economic growth. As the world navigates this digital revolution, the United States stands at the forefront, playing a crucial role in shaping the future of digital asset innovation.

The Evolution of Digital Assets

Digital assets have evolved from the inception of Bitcoin in 2009 to a diverse ecosystem that includes various forms of digital representations of value. Cryptocurrencies like Ethereum have introduced smart contracts, enabling decentralized applications (dApps) and services beyond simple value transfers. Stablecoins, which are pegged to traditional currencies, offer stability in the otherwise volatile crypto market. Meanwhile, NFTs have revolutionized the art and entertainment industries by providing verifiable ownership of digital assets.

Technological advancements, particularly blockchain technology, have underpinned these developments. Blockchain ensures transparency, immutability, and security, making it the backbone of digital assets.

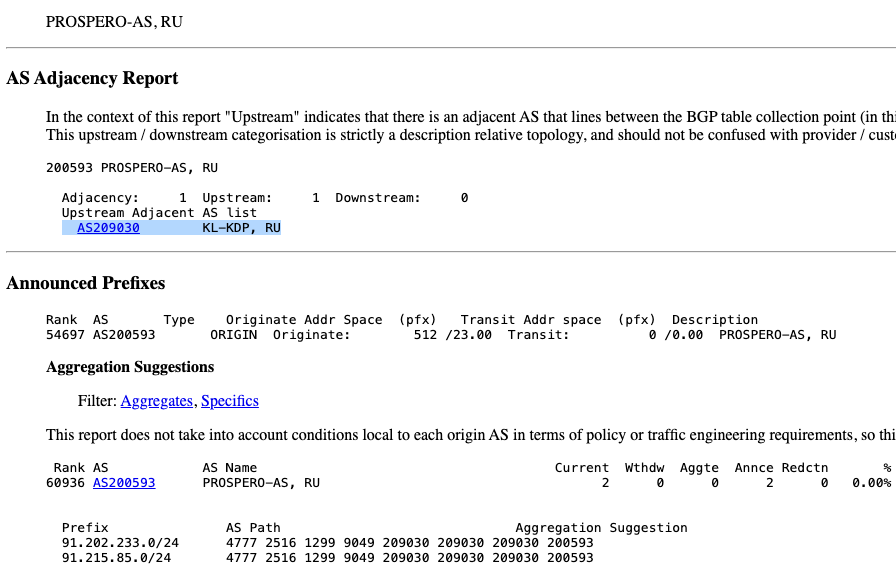

| Digital Asset | UP Percentage | Trading Price |

|---|---|---|

| Bitcoin (BTC) | 3.24% | $69,982.76 |

| Ethereum (ETH) | 0.72% | $2,446.14 |

| BNB (BNB) | 2.60% | $567.54 |

| Solana (SOL) | 4.58% | $166.93 |

| Dogecoin (DOGE) | 8.46% | $0.1732 |

These figures reflect today's market trends and show a positive reaction to recent developments, possibly linked to the U.S. Re-election of President-elect Donald Trump and ongoing regulatory discussions.

Current State of Digital Asset Innovation

The digital asset space is rapidly expanding, with innovations impacting industries ranging from finance to healthcare. For instance, decentralized finance (DeFi) platforms enable peer-to-peer financial transactions without intermediaries, while blockchain-based supply chain solutions enhance transparency and efficiency.

Case studies highlight the success of these innovations. For example, Ethereum's shift to proof-of-stake (PoS) with Ethereum 2.0 aims to reduce energy consumption and increase transaction throughput. However, challenges persist, including regulatory uncertainty, cybersecurity threats, and market volatility.

The Role of the United States

The United States has been pivotal in driving digital asset innovation through policy frameworks and government initiatives. The Biden Administration's Executive Order on Ensuring Responsible Development of Digital Assets underscores the nation's commitment to fostering innovation while protecting consumers and mitigating risks.

U.S. regulatory bodies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are actively involved in establishing guidelines for digital assets. These efforts aim to strike a balance between encouraging innovation and safeguarding financial stability. Recently, digital asset stocks have shown a positive trend, reacting favorably to recent developments, possibly linked to the U.S. election results and ongoing regulatory discussions.

Additionally, the U.S. collaborates with international bodies and the private sector to shape global standards for digital assets. This collaboration ensures that the United States remains a leader in this rapidly evolving digital assets field.

Future Trends and Predictions

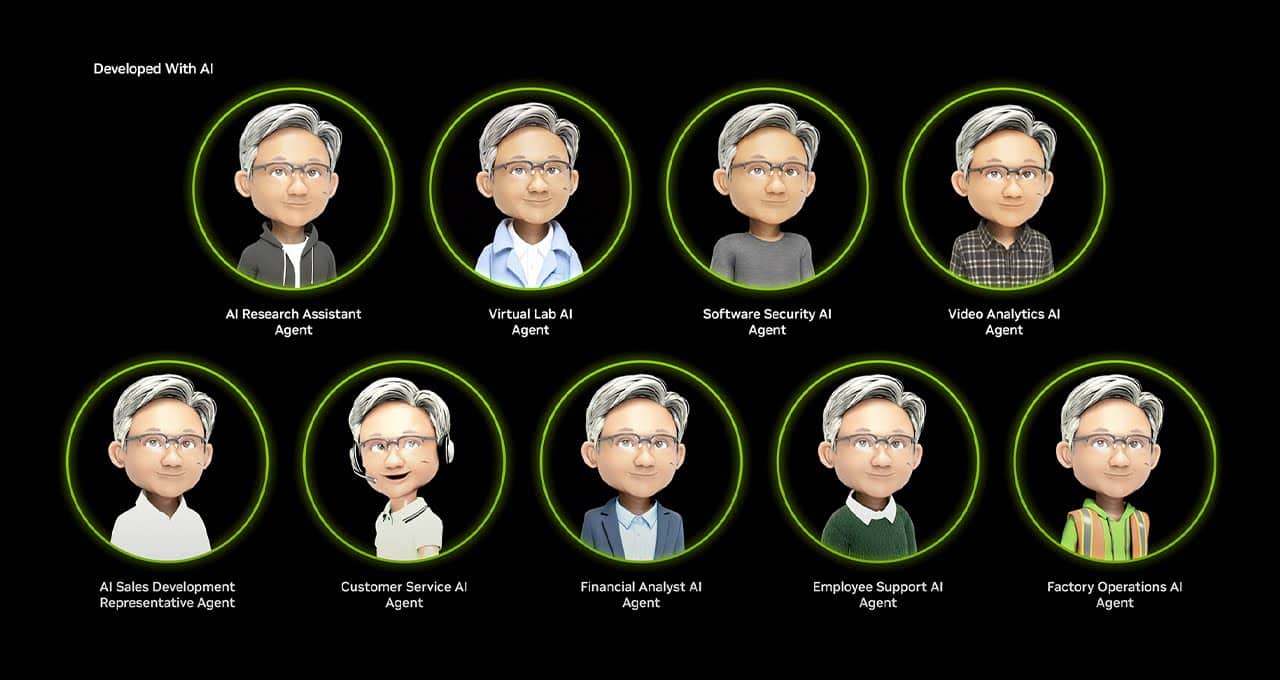

Looking ahead, several emerging technologies hold the potential to further revolutionize digital assets. Quantum computing, for instance, could enhance the security and efficiency of blockchain networks. Moreover, the integration of artificial intelligence (AI) with blockchain could lead to smarter and more autonomous systems.

Market analysts predict significant growth in digital asset adoption, driven by institutional investment and increased consumer awareness. As the ecosystem matures, we can expect more robust and user-friendly platforms, making digital assets more accessible to the general public.

Regulatory changes will also play a crucial role in shaping the future of digital assets. Proactive and adaptive regulations can foster innovation while addressing the associated risks.

The Global Perspective

While the United States plays a leading role in digital asset innovation, other countries are also making significant strides. For instance, China's Digital Yuan initiative showcases the potential of central bank digital currencies (CBDCs). Similarly, the European Union's Markets in Crypto-Assets (MiCA) regulation aims to create a harmonized regulatory framework for digital assets across member states.

The United States' leadership in global governance of digital assets is crucial for establishing international standards and fostering cooperation. This leadership presents opportunities for collaboration and competition, driving global innovation forward.

Conclusion

In conclusion, digital assets represent a transformative force in the financial landscape. The United States' proactive approach to fostering innovation while ensuring consumer protection positions it as a key player in this digital revolution. Continued innovation and responsible development are essential for harnessing the full potential of digital assets. As the world embraces this new era, the United States' leadership will be instrumental in shaping a future where digital assets drive inclusive and sustainable growth.